INVESTORS

“Ninety percent of all millionaires become so through owning real estate.” - Andrew Carnegie

Type of Investors

- 1st Time Investors

- Move-up Investors

- Portfolio Investors

- Performance Investors

- Rehab and Resell Investors

First-Time Investor

The first-time investor has never purchased real estate as an investment vehicle but likely has purchased real estate as their personal residence. This type of investor has a very low risk tolerance and little or no experience; however, this is the starting point for most investors.

Move-Up Investor

The move-up investor either owns a home outright or owns a home with payments low enough to support becoming a rental property that cash flows at market rent. Rather than sell the home currently owned, a move-up investor can rent the home, have a tenant pay for equity and cash flow, and then purchase another property. This type of investor has a very low risk tolerance and currently owns a home that can be rented.

Portfolio Investor

The Portfolio Investor purchases a property every one to three years. This type of investors are typically conservative but understand the benefits of real estate and have incorporated it into their long-term investment plan. This type of investor has a low risk tolerance and is experienced.

Performance Investor

The Performance Investor purchases at least one property to hold every year. These are typically high net-worth individuals who understand the value of large cash-flow real estate portfolios. This type of investor has a low to medium risk tolerance and is very experienced.

Rehab and Resell

The Rehab and Resell investor purchases property for rapid improvements and quick, but profitable, sale. This type of investor has a high risk tolerance compared to the other types, is very experienced and is looking for Trustee Sale, REO, Short Sale and Probate properties that can be purchased below market value.

Benefits of Real Estate Investments

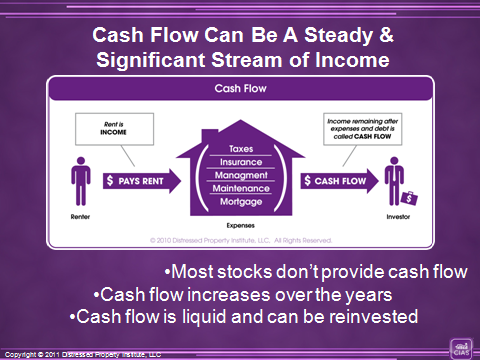

· Cash Flow

· Appreciation

· Leverage

· Taxes and Deductions

· 1031 Exchanges

· Depreciation

Sources of Investment Funds

· Traditional Mortgage

· Home Equity Loans

· Home Equity Lines of Credit

· Private Lenders

· Self-Directed IRA’s

· Partnership

Tax Benefits

- Depreciation allows yearly deductions on improvements to the property

- 1031 exchanges defer capital gains taxes

- Self-Directed IRA investment opportunity

About Us

About Us Services

Services Featured Listings

Featured Listings News

News Contact

Contact Home

Home